How to Collapse: Hyperinflationary Depression

How crop failure leading to a 20% caloric deficit might cause a financial crisis.

It's Wednesday. You wake up, let the dog out for a piss, shower and drag yourself to work. Eight to ten hours of pointless grin-fucking pass by and you're ready to collapse on your sofa with a mind-bending substance to stare at the idiot box for the rest of the night.

If you're lucky, you have a companion with whom to share your misery.

The joy you once had for life has turned to drudgery and you wonder where you went wrong. The thing is, for most of us this is life now.

The weekly jaunts to a family restaurant: gone. Too expensive.

The desire to achieve greatness at work: that died with your youthful vigor.

Extended family: torn apart by tribalism.

A home to call your own: Only for the rich. 80% of Canadians believe ownership is now only for the wealth.

It wasn't always like this. I can't pinpoint when this all began, but it feels like everything started deteriorating at the turn of the century.

There are many causes and symptoms, but two deeply scarring events helped tip the West into decline. September 11th, 2001 cracked the veneer of trust within America. Enabled by new technologies, governments salivated at the ability to wrest control in the name of security. The surveillance state reached maturity.

The global financial crisis also gave us a peak behind the curtain of capitalism. It demonstrated how the winners and losers of capitalism were demarcated, with captains of industry bailed out while individuals were held to account. Wealth and power became inseparable, forging an impenetrable barrier beyond which most will never reach. The wealthy - still unhealthily revered by most - gained more control and extended the moat between them and the unwashed masses.

Over the past two decades, truth, justice, equality, safety and wealth were compressed upward, only accessible to the top 1%.

Obvious to few, this is what collapse looks like. Driven by an overextended market system, corporate lobbyists and captive government administrators, declining energy return on energy invested (EROEI), falling productivity gains, geopolitical threats and a heating planet.

A system this expansive takes multiple headshots before toppling. Unfortunately, we're now in round 10 and our knees are buckling.

Perhaps someday collapse will look like Mad Max. For now, it's a grind accelerated by the occasional crisis. It's your shitty boss that hasn't given you a pay raise in 3 years. It's the slim chance your kid will ever afford a house, even with a financially crippling college education. It's wars in far-off lands about things that don't seem to make sense. It's militarized police defending capital at the expense of labor. It's emotion over rationality.

We've been in a slow decline for years, but someday there will be another shock to the system. I don't know when or where, but if not geopolitical, financial or medical, it's origins will be agricultural.

Of course, these are all interrelated. One leads to the other and vice versa. As I illustrate below, even a moderate agricultural failure would have dire financial consequences.

UK farmers are warning of 20-30% crop shortfalls and olive and cocoa prices have skyrocketed. 2023 saw the worst wine grape harvest in 62 years. Whether this year or next, I think crop failures will soon grow large enough to create a food supply shock for the world.

A 20% decline in caloric availability isn't an extinction-level event, but is sufficiently large to cause mass panic. One might expect everyone to evenly consume 20% fewer calories. However, that wouldn't be the case. This level of shortage turns a game of checkers into 3d chess, where those with the means will seek to dominate the chessboard.

Food scarcity would ironically increase caloric acquisition by certain powerful groups. Wealth and power would consolidate further ensuring the plutocrats eat first, hoarding whatever else they can while everyone else makes do with less. Many would starve, and those caught in the middle would enter a new socio-economic paradigm.

Economic re-shuffling would salt the stresses we already feel today. The effects of a global caloric deficit would send panic around the world.

Remember when people fought over Costco toilet paper and hoarded hand sanitizer? This will be much worse.

While violence takes center stage in a food shortage, this article is focused on the financial outcome.

In 2020, while the supply chain shut down halting economic activity central banks pumped liquidity into the financial markets, corporate balance sheets and individual pockets.

Money printing and fiscal expansion are the default reactions to economic ailments, regardless of the cause. This has been the playbook for decades. While this strategy could work to stimulate demand-driven slowdowns, it is inflationary when the slowdown is supply-driven. Too much money chasing too few goods.

This is exactly what happened during Covid. A supply shock collided head-on with massive monetary and fiscal expansion, sending inflation soaring. We are still struggling to tame the last leg of sticky inflation. Of course, while inflation (the rate of change in prices) is slowing, prices remain at their new high water mark. It will take years for wages to catch up, if they ever do.

A significant drop in global food production could create a similar economic shock, again causing central banks and governments to respond by creating and spending money. During Covid, the supply shocks were challenging but solvable with certain health measures and rapid vaccine development. We would have much less control if global food production dropped by 10-20%. There would be no quick fixes, if any. That would be up to mother nature.

As the food supply shock drags on, so would the monetary and fiscal response. Governments would be incentivized to throw money at people to stop them from rioting in the streets. This would be highly inflationary - more so than during the pandemic.

Worse yet, some populist politicians seek to kneecap the Federal Reserve's independence. If this happened, what little prudence existed would evaporate and the printing presses would become politically tainted. Election at risk? Print money. Constituents complaining? Print money. Once the Fed loses independence, governments would paper over every problem with more money.

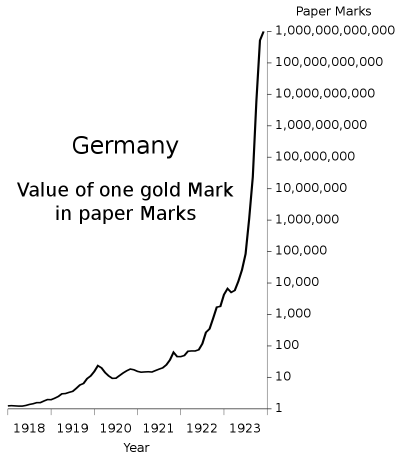

We've seen what happens when central banks bend to the fiscal whims of politicians. Zimbabwe, Yugoslavia, Hungary and Weimar Republic are great examples. These countries experienced hyperinflation, completely destroying middle class savers and those on fixed incomes. The only people who benefited were those who transferred their wealth into foreign assets or hard assets.

Hyperinflation sounds far fetched, but that doesn't mean its impossible. Five years ago, breaching 1.5 degrees Celsius and a NATO vs. Russia proxy war in Ukraine seemed improbable. Don't mistake the unfamiliar for the unlikely.

When you follow the logic through to conclusion, hyperinflation enters the realm of realistic possibility. If the poly-crisis unfolds as many expect, we will likely see relentless supply shocks in the near future. An independent or government-controlled central bank will print money in response. Inflation rises. Without a solution to the supply shock, the central bank response will persist far longer than it did during Covid.

Unlike the experience in the Weimar Republic or Zimbabwe, the inflation won't be localized. A global crisis necessitates a global response. All central banks around the world would respond in tandem, creating inflation everywhere. Therefore, shifting assets into foreign currencies wouldn't provide the same hedge as it did in historical hyperinflationary episodes. All currencies would depreciate in value. Instead, hard assets - e.g. gold, tools, skills, seeds, land, commodities - would provide the main reprieve.

For those asking "what's the point...aren't we all going to die in a collapse anyway?". Perhaps, but there's also a chance that crop failures are followed by better harvests in subsequent years. Even if a yields don't recover, a rapid population adjustment or other temporary forms of adaptation could alleviate short-term pressure leaving the remaining souls to live in the aftermath. There are so many pathways to the future - it's reasonable to hedge your bets.

Like I said, this is 3d chess. A long drawn-out grinding process is just as likely as any other tempo of collapse. It's important to prepare for the possibility you might need to survive for a couple decades in a dystopian world.