Collapse of the AI Bubble

Why, when and how

Warning: this is not financial advice. I could be totally wrong. I could be right but early. Who knows. This is just my view of the world at the time of writing, formed by researching and interpreting numerous analyst reports. Their views and my views will undoubtedly change over time as new information is unveiled.

I've been researching the AI bubble for personal reasons and thought a few of my readers mind have their own insights. Share your thoughts in the comments.

Key Takeaways

- The stock market is "pricing perfection" while ignoring fundamental economic fragility and historically high valuations.

- AI infrastructure spending (up to $500 billion annually) is at an unprecedented scale, requiring the funding of a new Apollo program every 10 months.

- The "Magnificent Seven" exhibit negative Free Cash Flow (FCF), contradicting the historical "capital-light" model that drove tech valuations.

- The AI business model is defined by "dogshit unit-economics", where rising costs and low real-world utility make the current investment volume economically unviable.

- The CapEx is financed by debt and fragile vendor financing schemes, creating a corporate debt bomb vulnerable to an economic slowdown.

- The confluence of these factors suggests the period of acute risk for a major market correction is probably concentrated over the next 12 to 18 months (although nobody can time these things precisely).

I. Pricing Perfection vs. Economic Reality

The U.S. stock market is detatched from fundamental economic signals, with valuations currently "pricing for perfection". The dominant market narrative is one of sustained AI-fueled growth. However, this growth story is structurally fragile, underpinned by unsustainable capital expenditures (CapEx) and funded by debt. The system displays clear pathologies of a financial bubble, and a major correction has a non-zero, and increasing, probability of occurrence. The period of acute risk is probably concentrated sometime in 2026.

II. The Fragile Foundation: Economic and Policy Risks

The U.S. economy's ability to withstand a shock is low, as buffers built during the pandemic era, such as excess savings and ample job openings, are depleted. Furthermore, the labor market signals weakness. Job creation runs at only two-thirds of the rate needed to stabilize unemployment. This is compounded by data suggesting over 95% of recent job gains have been attributed to flawed model estimates. Worsening initial unemployment claims could soon confirm the recession narrative.

The economy is further constrained by structural factors. Developed nations have reached a point where the high growth needed to service accumulated national debt is difficult to generate. (Marginal productivity of debt is <1.) This constraint is particularly relevant given high U.S. government deficits that limit the Federal Reserve's response capability. For every dollar of revenue the U.S. government receives, it spends $1.40.

Adding to economic fragility is the threat of stagflation, driven by conflicting price signals. Tariffs drive a broad-based rise in consumer prices (CPI), while simultaneously squeezing corporate profits. This pressure on corporate margins is expected to double in 2026.

The Federal Reserve faces a dilemma: cutting rates risks igniting inflation, yet holding rates risks worsening unemployment. The thing is, the Fed is always 6-18 months behind due to monetary policy transmission lags, so whatever it does today wont be felt until later next year.

Bottom line: The economic backdrop is fragile.

So why are markets near all time highs?

III. The AI Promise: Abundance, Productivity, and Job Displacement

The market’s bullish consensus is built on the promise that generative AI (GenAI) will act as a general-purpose utility triggering unparalleled productivity gains and ushering in an era of disinflation and abundance. Financial forecasts reflect this, projecting S&P 500 earnings growth and the creation of trillions in market value, at the expense of human jobs.

However, these forecasts may be overstated because they ignore fundamental flaws. Namely, the economic unviability of the underlying technology.

IV. AI's Structural Flaws and Financial Engineering

The AI boom is structurally flawed, characterized by "dogshit unit-economics" (Cory Doctorow). Unlike successful past technologies that became cheaper with scale, AI is on a path where:

"Each generation of AI has been vastly more expensive than the previous one, and each new AI customer makes the AI companies lose more money" (Cory Doctorow).

This makes the technology currwntly unaffordable for widespread, low-value tasks like drafting emails, limiting its utility to high-value niche applications.

The financial contrast is stark: current CapEx spending (up to $500 billion annually) runs against both a lack of AI-associated revenue, never mind cash flows. Return on invested capital is weak.

This results in an $800 billion gap between vision and reality, underscoring the unviability of the growth model.

"Bain & Co says that the only way to make today's AI investments profitable is for the sector to bring in $2 trillion by 2030... How much money is the AI industry making? Morgan Stanley says it's $45b/year... The Journal quotes David Cahn, a VC from Sequoia, who says that for AI companies to become profitable, they would have to sell us $800 billion worth of services over the life of today's data centers and GPUs." (Derek Thompson)

The speculative CapEx is creating significant balance sheet risk, reminiscent of the dot-com era's telecom bust. Stress cracks are already showing - "free-cash-flow growth from the ‘Magnificent Seven’ market leaders is now negative" (Morgan Stanley Global Investment Committee).

The erosion of cash flow directly contradicts the "capital-light" model that previously drove tech valuations. Morgan Stanley's analysts note that:

"Historically, shrinking free-cash-flow growth has been a headwind for high-flying growth stocks".

"The Apollo program allocated about $300 billion in inflation-adjusted dollars to get America to the moon... The AI buildout requires companies to collectively fund a new Apollo program, not every 10 years, but every 10 months." (Derek Thompson).

This enormous spending is occurring despite studies showing that 95% of AI pilot projects have yet to yield a measurable return or profit. Many users don't use LLMs daily, and many only use for personal matters.

This is not to say the technology is useless. Rather, the use cases are not cost effective. While the technology may provide a positive ROI at some point (similar to historical technology build-outs), it currently does not. We have a case of too much money chasing too little returns.

Moreover, the longevity of these energy-sucking investments are questionable in a collapsing world. Companies are spending trillions on infrastructure that might be both economically and physically unviable.

V. Why the AI Bubble Must Collapse

The prevailing assumption that the AI boom can simply sustain itself or coast until return on investment (ROI) catches up is not supported by the financial mechanics and debt structure of the system. The collapse is inevitable because the cost base is dynamic and rising, while the funding structure is fragile. Capital is skittish, and someone will wake up and realize they no longer want to throw bad money after good. That's when the rush for the exits begins.

The AI buildout suffers from a fundamental negative feedback loop:

Dynamic Cost Base: The cost of the technology is not fixed. Because "Each generation of AI has been vastly more expensive", the cost of operations (training new models, upgrading hardware) is constantly increasing. Revenues and cash flows must grow rapidly to cover this accelerating cost structure. In reality, currently, companies incinerate cash at an ever-faster rate.

The Debt Trigger: The boom is not financed by cash on hand, but by debt and vendor financing. Cash flow is required to repay debt, but insufficient cash flow triggers defaults on these fragile structures.

The Growth Signal Requirement: The vast CapEx is a desperate maneuver by monopolistic firms for a growth story. If FCF fails to grow, investors will eventually recognize that the investment has failed to produce the required ROI, leading to a sudden, massive withdrawal of capital or asset writedowns. The market demands parabolic growth to sustain the valuations; anything less is interpreted as failure.

VI. Systemic Financial Risks and Collateral Damage

The AI investment is financed by highly leveraged and opaque methods. This involves intricate accounting methods designed to conceal the true cost of investment.

Firms use accounting tricks to disguise costs. This includes the practice of booking intercompany transactions, such as server credits, as both revenue and investment simultaneously. Furthermore, large firms are "shifting huge amounts of AI spending off their books into SPVs, or special purpose vehicles, that disguise the cost of the AI build-out" (Derek Thompson).

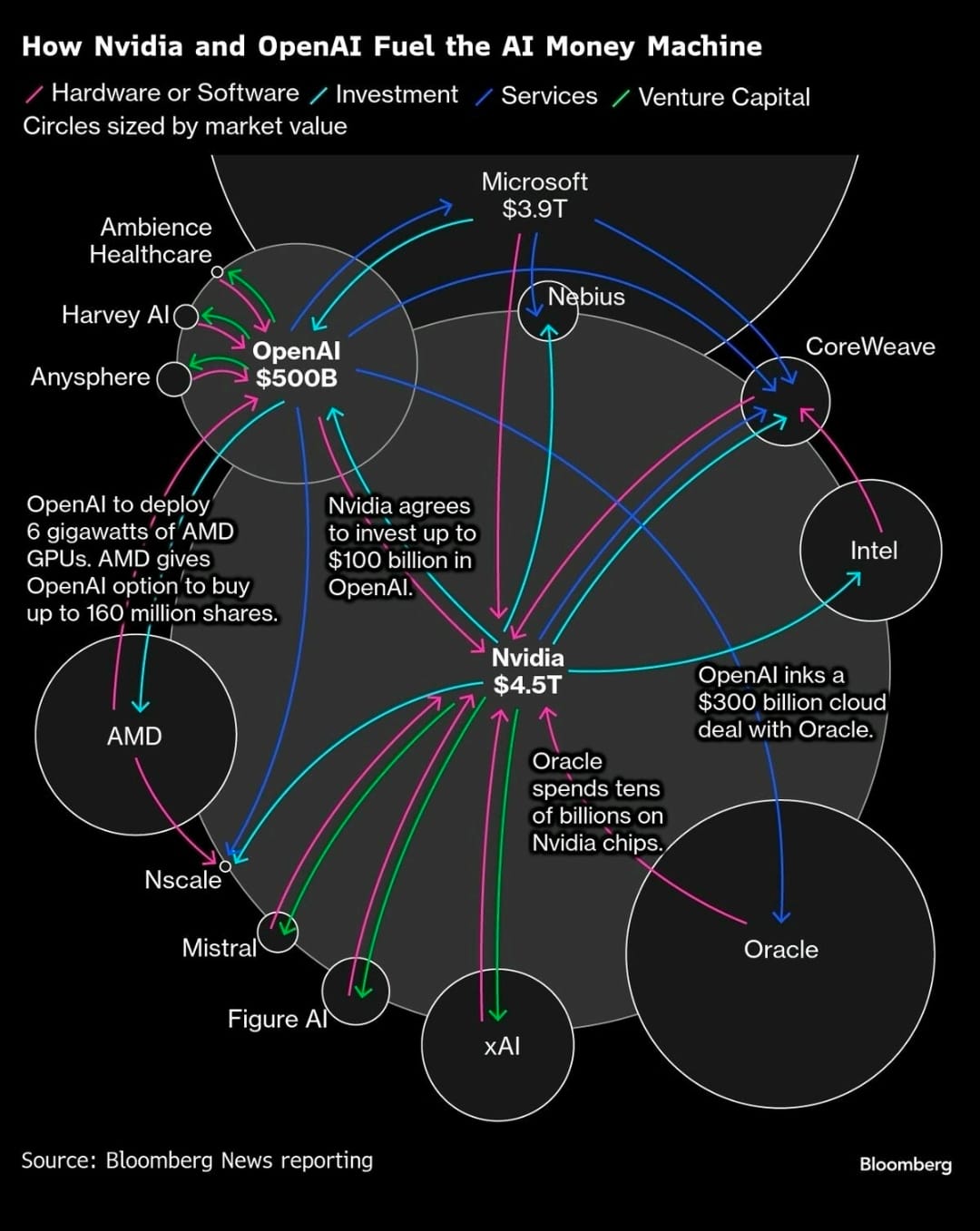

The CapEx is reliant on a vendor financing structure, where suppliers essentially fund their customers' purchases. A recently reported $100 billion chip supply deal is evidence of this fragile, internally-financed ecosystem. The use of highly depreciable Nvidia GPUs as loan collateral further increases risk.

The AI boom is generating risk across the broader corporate landscape.

Junk Debt: Corporate reliance on aggressive financing is high, with some firms borrowing money at over 7% to fund share buyback programs. The rush to issue junk bonds to finance data center construction, packaged as a sure bet on the future of AI, has increased overall corporate debt risk. Corporate debt service costs have reached a 15-year high.

The Capital Siphon: The concentrated AI spending acts as a "death star" of capital. This phenomenon is described by Paul Kedrosky:

"If I’m a small manufacturer and I’m hoping to benefit from the on-shoring of manufacturing as a result of tariffs, I go out trying to raise money with that as my thesis. The hurdle rate just got a lot higher... So I end up inadvertently starving a huge slice of the economy yet again, much like what we did in the 1990s." (Derek Thompson, Paul Kedrosky).

This capital starvation undermines tariff-driven attempts to stimulate domestic manufacturing.

VII. Conclusion: Timing and the Defense Strategy

The confluence of negative signals suggests the acute risk window for a market correction could be over the next 12 to 18 months. Timing is imprecise and new information could change this. Until then, the market could keep rising as the bubble inflates.

The event that punctures the bubble will occur when investors can no longer ignore the unsustainable foundations.

Watch for the following signals:

- CapEx Peaks: The "Magnificent Seven" are compelled to announce a decline in CapEx.

- Recession Confirms: Rising unemployment claims unequivocally confirm the economic downturn.

- Liquidity Breaks: Complacency shatters, causing volatility to spike.

No market outcome is certain. This report is not a prediction, but an examination of an outcome, a significant market crash, that has a non-zero, and increasing, probability of occurring. The financial consequences of this specific outcome warrant active planning, with special consideration to capital preservation.

This is not financial advice.