"Good Luck with Collapse": Grandma Blowing Kids' $150k Inheritance on a Cruise

Gen Z is left holding the bag as civilization crumbles.

I recently read about a 78 year old grandmother who is blowing her kids' inheritance on a $150,000 3 month cruise.

Go out with a bang, I guess.

Put aside, if you can, the fact that this cruise is an egregious display of consumerism. Let's ignore, if possible, the destruction the cruise industry wreaks on the planet. Instead, let's consider whether she is being selfish.

Unlike those who lived through the late 20th century, young adults and children today face a perilous future. One punctuated by declining living standards, scarcity and violence.

Younger generations need all the help they can get. Does Grandma have a moral obligation to share that $150,000 with her descendants?

Grandma's perspective: It's her money

It's Grandma's money and she can do what she wants with it. She's worked hard all her life and deserves to spend her last years enjoying herself.

From her perspective, she's fulfilled her duty as a mother and grandmother. She raised her children to be fully-competent and independent adults. Isn't that the goal of any parent in the natural world?

She would argue she doesn't owe anything to anyone, except herself.

Western society is individualistic in nature, so many would agree she's entitled to do as she pleases, even if her spending choices are questionable.

Do parents have an obligation to their kids and grandkids?

In contrast, I believe parents are obligated to do everything they can to support (not enable) their children and grandchildren. No child asked to be born, so parents have a moral obligation to help (within reason) - even as kids reach adulthood.

Despite adult children gaining independence, I believe parents should still provide support. Education, skills development, housing, child-rearing and daily chores are all ways parents can help. Some have different means, but parents should generally do what they can to improve the lives - and futures - of their families.

Some parents can help financially, others can't. That's OK - not everyone was dealt the same hand in life.

Everyone would agree that underage dependents should be fully supported. However, many argue the obligation ends as kids become independent adults.

Many parents - and grandparents, such as the one I mentioned above - have a laissez faire attitude to family financial cohesion. These parents feel they completed their 'duty' by the time the kids were off to university, and now they're on their own.

Frankly, I used to think this way too. It's probably something I picked up from my parents.

But the more I learned about what the future holds, the more I saw why the family must remain unified, rather than a struggling collection of individual components. Social and economic cohesion builds resilience, and that begins with the family.

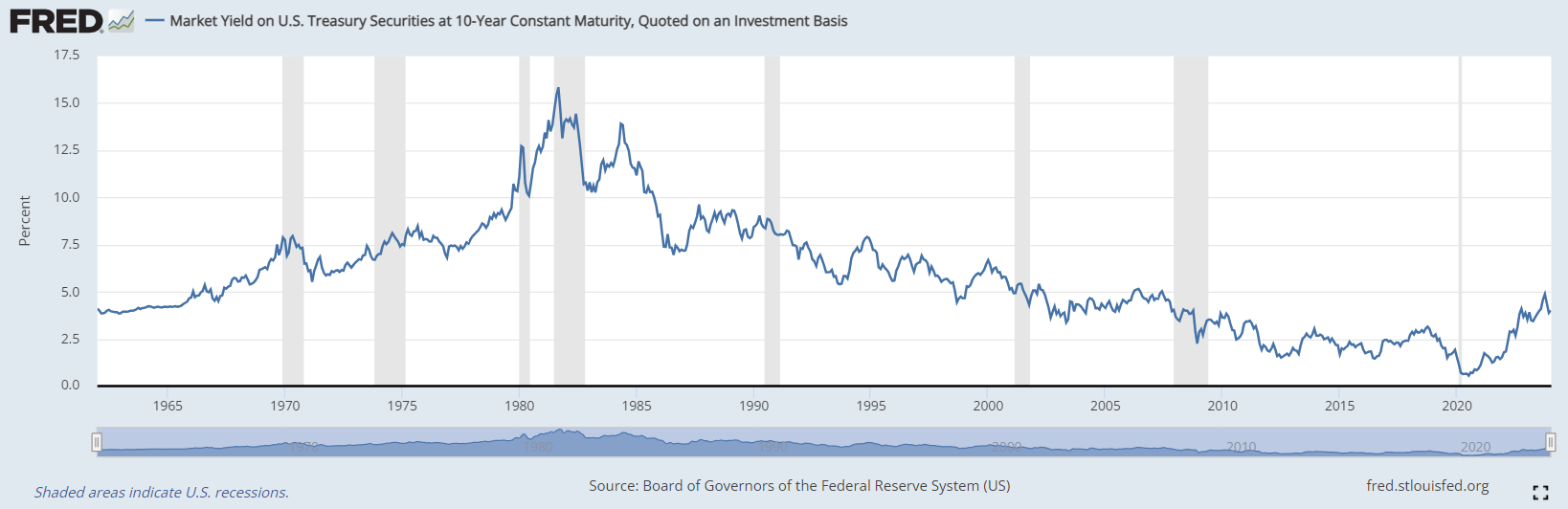

Perhaps there was a time a self-reliant person could pull themselves up by their bootstraps and make a small fortune. There are many Baby Boomers who built lucrative careers - crowned by lucrative defined benefit pensions - with only a high school education. Moreover, Baby Boomers benefited from an economic tailwind as the post-war peace dividend, Green Revolution and secular decline in interest rates boosted growth and asset prices worldwide.

This economic tailwind was made possible by easily accessible, cheap fossil fuels and the exploitation of our environment.

Virtually free energy and the technological advancements enabled by energy created the surplus that elevated human prosperity. With this surplus, human civilization for the first time could afford to house, feed, educate and provide for billions of people. Those in the West benefited the most.

In addition, by ignoring the environmental costs of this surplus, older generations effectively embezzled from the planet while deferring the repercussions to their descendants.

Prosperity lost

Around the turn of the century, energy became more difficult and expensive to find and extract. Consequently, civilization has started bumping into hard limits, and real wealth creation for the average person has slowed considerably. We see this manifested in the cost of living crisis, widening wealth inequality, the global march towards fascism and geopolitical threats.

This means that younger generations are disadvantaged compared to previous generations.

The free lunch afforded to Baby Boomers has vanished as cheap energy is depleted and deferred environmental costs come to bear. Gen Z is left holding the bag while Boomers use their unearned gains to take extravagant vacations.

Laissez faire parenting might have worked with the Baby Boomers because so many other invisible hands were lifting that generation. In contrast, Gen X, Millennials and, especially, Gen Z have minimal support outside of the family unit.

Frankly, the only young adults I see getting ahead are ones who are either super lucky or received significant help from their parents. Hard work isn't enough anymore.

The cost of the Baby Boomers' windfall rests on Gen Z, which is inheriting a world of violence and want. They need all the help they can get and previous generations - especially family members - have a moral obligation to help in any way they can.

Does it even matter?

According to the story I read, if Grandma hadn't taken a 3 month cruise each of her grandchildren would have received a $25k inheritance. It's not a life-altering amount, and some would argue money is useless where we are headed. So does it even matter?

Money might be useless at some point in the future, but today money means something. Today, money can buy skills, tools, resources and knowledge needed to improve resilience as we enter this new world. The money could also help the grandchildren pool together to buy land or move to a more resilient location.

Maybe the money simply is used to put food on the table. Many people are struggling just to get through the next month, never mind the next decade. The cost of living has soared, and will continue to rise if resources become more scarce.

Importantly, asking "does it even matter?" implies near-term civilizational collapse to a point where money is meaningless. While this may be on the horizon, nobody knows when or how this could happen. There's no sense writing off the future just because it will likely get bad at some point.

The problem with writing off the future

During the height of the AIDS epidemic of the 1980s and 1990s, patients diagnosed with HIV (the precursor to AIDS) received a death sentence. They had months to live. Years, if they were lucky.

Many reacted accordingly, spending down their life savings, quitting their jobs and abandoning their future. For a long time, this made perfect sense. With no descendants who would they leave it to?

However, as treatment improved there came a point at which HIV no longer guaranteed death. Unfortunately, few could foresee this turning point and many HIV patients went broke, unprepared for a future they never thought existed.

From an article in the San Francisco Chronicle:

In the darkest years of the epidemic in the 1980s and ’90s, AIDS was almost always fatal; the prognosis was a few years, maybe a few months. These men, then in their 20s and 30s, weren’t supposed to make it to 40. Now some are 60 years old, even 70, still alive but wounded physically, psychologically and economically.

For many, time stopped when they were diagnosed. They let go of futures they had no reason to believe would ever arrive. So they have no savings, no retirement money, no strategy for continuing to live in a city that’s increasingly unaffordable. Over the next decade or so, many will need financial aid when private disability benefits run out.

I see the same thing happening with today's young adults. Many have completely written-off the future due to climate collapse, war or something else. They've given up on education, a career and investing. Many are pre-planning their eventual suicides.

"Investing for the future" sounds cute when the walls around us are crumbling, but assuming we have no future can become a self-fulfilling prophecy. At best, collapse is a drawn-out process in which money and savings still have a purpose.

My point is we don't know what will happen in the future. We need to be realistic about humanity's predicament, but at the same time we must balance living today with living tomorrow.

So the decision Grandma makes about her money and the support she can provide to her descendants is important.

Final thoughts

Compared to their ancestors, the younger generation has been dealt a bad hand. Life - something they never asked for in the first place - is becoming increasingly harsh. Humanity is entering a period of great uncertainty and potentially collapse.

Older generations that benefited from the spoils of economic luck and environmental exploitation must do everything they can to support their descendants.