The Approaching Energy Shock

A massive oil shock could be just around the corner. And nobody is talking about it.

Like it or not, the world remains addicted to fossil fuels. Every aspect of our lives is dependent on cheap energy. Even at current prices, our lives are greatly subsidized by the plentiful energy found in a barrel of oil.

According to Nate Hagens, editor at The Oil Drum:

One barrel of oil has the same amount of energy of up to 25,000 hours of hard human labor, which is 12.5 years of work. At $20 per hour, this is $500,000 of labor per barrel. The average American consumes over twenty-five barrels per year. So each of us has a huge subsidy of energy behind the scenes that we often take for granted. Less oil, and much more expensive oil, will have huge implications.

Economic output is created by exploiting cheap energy to its fullest - to create goods, grow food and transport products.

Oil has a multiplicative effect on human labor. By applying the energy found in fossil fuels, humans have been able to multiply output per person, resulting in the surpluses needed to raise living standards and build societal wealth. Prior to the discovery of cheap energy and its multiplicative effects, most humans generally lived hand to mouth.

Humanity will forever be drawn to the allure of fossil fuels.

The final catastrophic outcome of burning fossil fuels is well known among Collapse2050 readers. However, in the short term, the world is approaching a crisis of another kind.

The world is currently teetering on the edge of a potentially devastating energy price surge, one that could have far-reaching consequences. This surge has the potential to ignite inflation, destroy consumer demand, and trigger a financial crash.

Near Term: Acute Supply-Demand Imbalance by Q4 2023

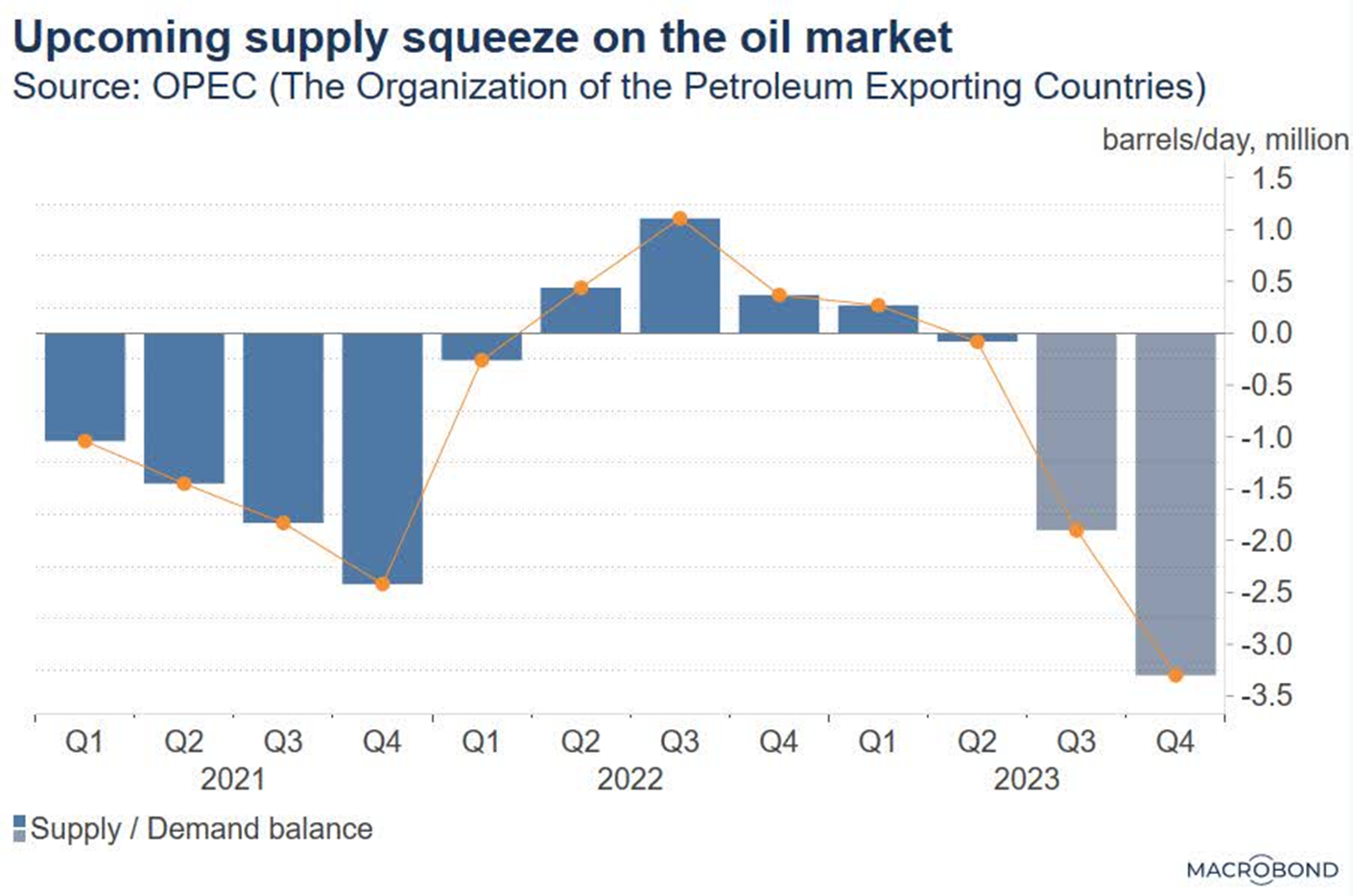

Due to Saudi and Russian production cuts, OPEC is forecasting a whopping 3.3 million barrel daily supply shortfall by the end of 2023.

This is massive and will require significant price adjustments or supply increases (unlikely) to balance the market.

At a time when the 30 year US mortgage rate is already over 7%, a spike in oil prices could prove highly destructive to economic activity. West Texas Intermediate has already jumped 33% since June.

Oil Inventories Are Depleted: Limited Shock Absorber

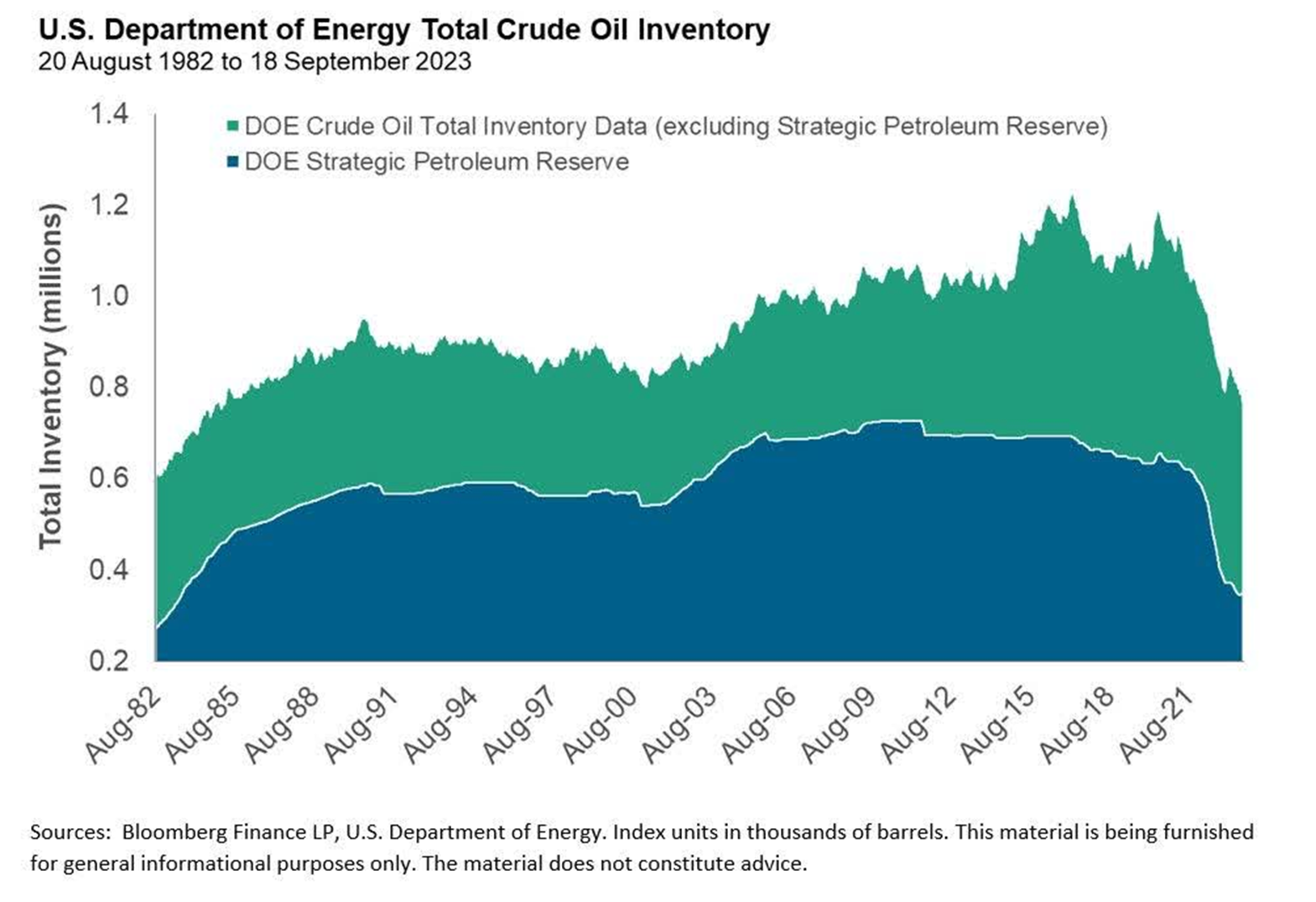

Adding to this pressure, oil reserves (i.e. oil held in storage) is critically low. This means that a supply-demand imbalance cannot be offset by tapping into inventories.

The US Strategic Petroleum Reserve (SPR) is about half its recent peak level. Overall inventories beyond the SPR are also significantly depleted. With oil prices at $90/bbl and a supply shortage, refilling these strategic reserves would be challenging and expensive.

This puts the US in a vulnerable position.

Why Should You Care? Energy Shock = Inflation Shock

The energy and petroleum derivatives provided by oil are highly useful. Consequently, oil has permeated every aspect of our lives - food, transportation, plastics.

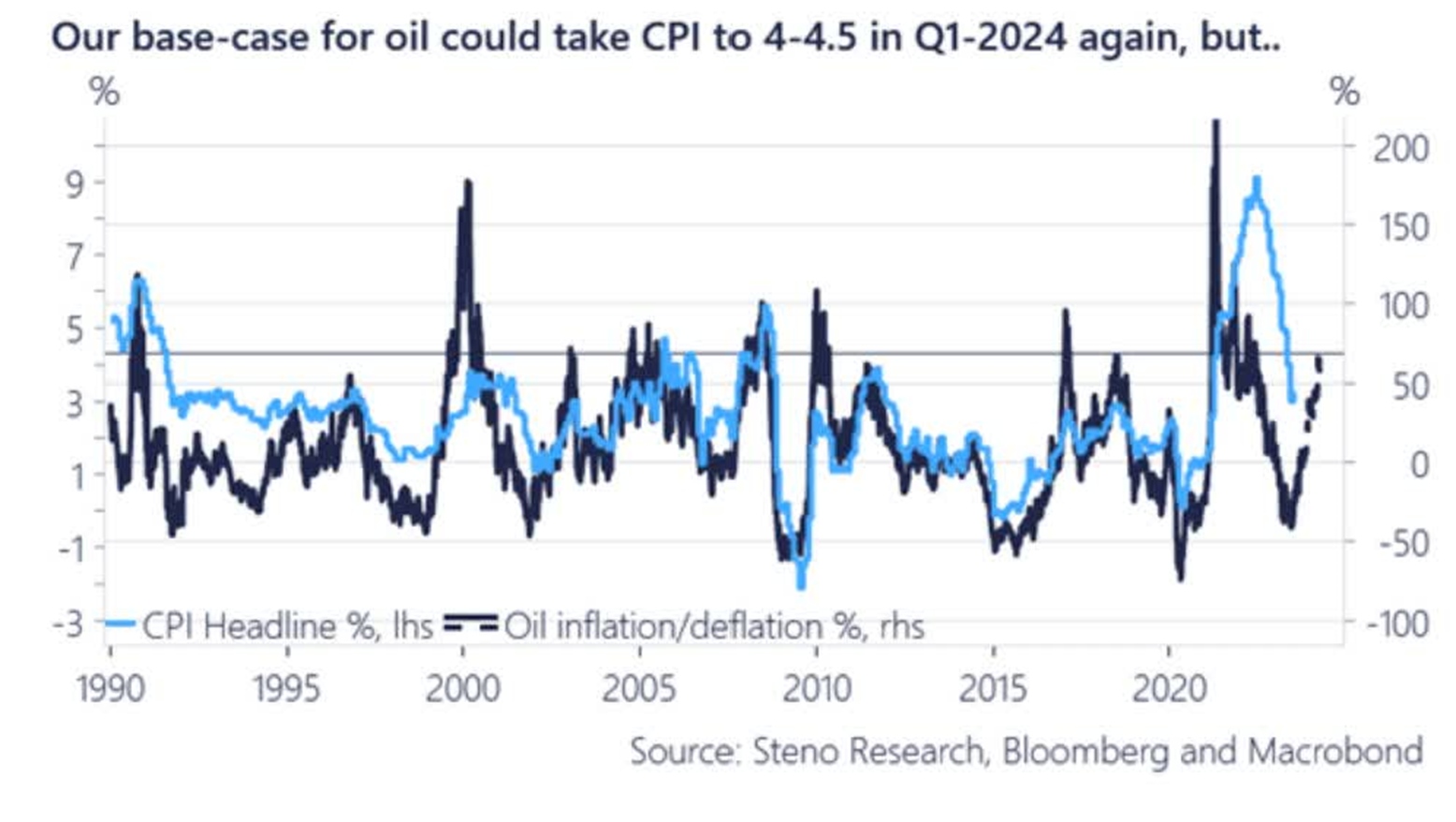

The immediate inflationary effects of higher oil prices are comparatively contained, however higher raw materials costs, electricity prices and transportation charges are soon passed on to finished goods. High headline inflation eventually feeds into core prices.

In response to higher core inflation, interest rates could rise further.

Simply, higher oil prices means a higher cost of living.

Oil Shortfall Could Be Weaponized For Geopolitical Advantage

With supply short and inventories low, the US - and rest of the developed world - is especially vulnerable to additional shocks. The US economy is already teetering on the edge of recession, with the consumer stretched to pay his bills.

With looming oil shortages and a US economy close to recession, I suspect America's enemies are weighing their options right now. Especially with an approaching Presidential election.

Russia - a major global oil producer - would love to pull the rug out from the US economy and give itself geopolitical leverage. If Russia cut its oil production by another 3-4 million barrels, oil prices would skyrocket. The implications of such an action could influence support for the war in Ukraine to Russia's advantage.

Russia cannot do this alone, but as the east - Russia, China, Saudi Arabia, Iran, India, North Korea - strengthen ties, it is not inconceivable they could act as co-conspirators to undermine a mutual adversary.

Longer-Term: It Gets Worse

Longer term, the situation is expected to worsen.

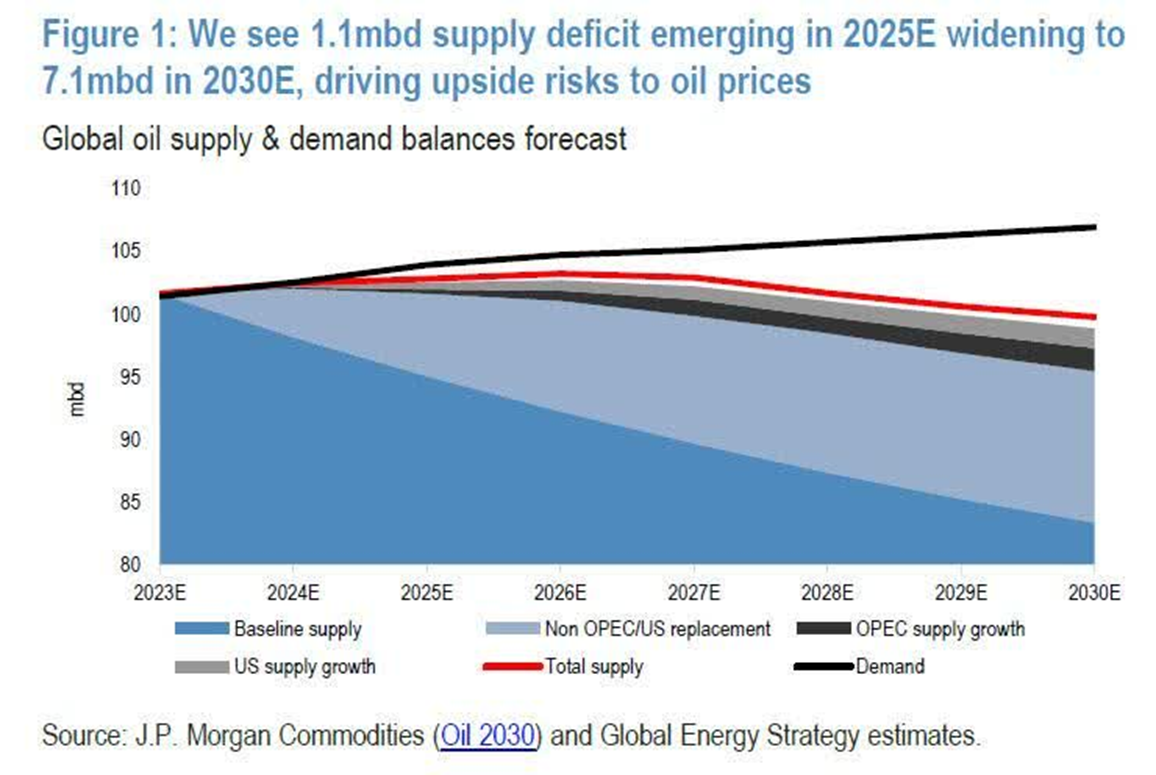

Investment bank JP Morgan is forecasting a 7 million barrel per day oil supply shortfall by 2030. This is more than 7% of current global production, and JP Morgan predicts the oil price could reach as high as $150/bbl.

JP Morgan believes the long-term shortfall is a result of three main factors:

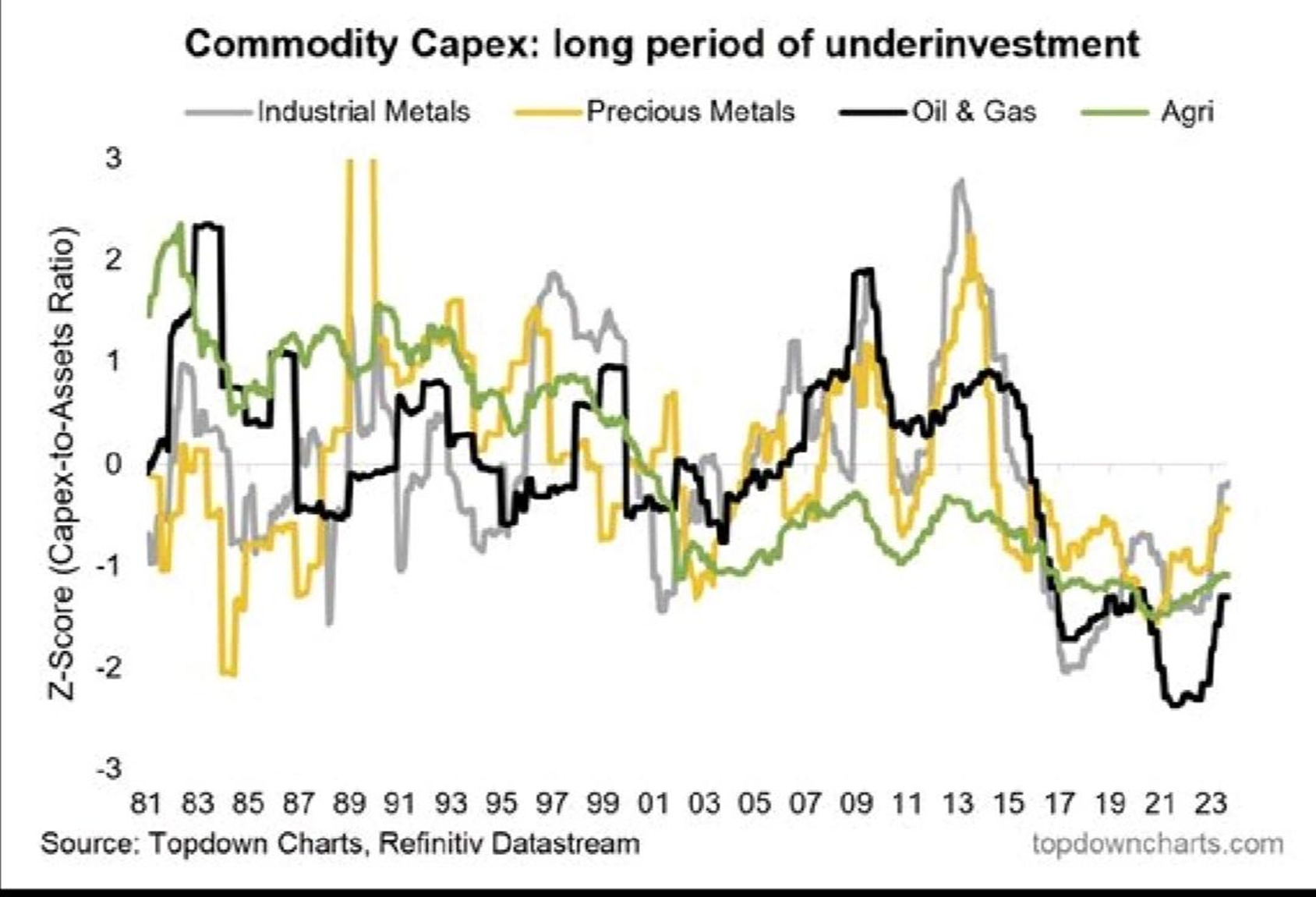

- Higher interest rates curtailing future capital investment and exploration, extending underinvestment in new exploration and production that began in 2015

- Elevated capital costs increasing oil's breakeven point

- Redirection of investment away from fossil fuels in anticipation of peak demand, shifting funds from capital expenditures to stock buybacks and dividend increases

Was This The Change You Were Looking For?

Absorbing all this data, part of me says "good". Maybe this will be crisis that forces humanity off fossil fuels. There's nothing like high prices to curtail demand and incentivize substitution.

Nevertheless, an oil shock would be painful.

I want readers to be prepared for the potential short-term and long-term shocks caused by oil shortages.

Subscribe to get more forecasts and strategies for riding out the collapse of civilization.